Naira has fallen to an all-time low against the dollar at Aboki Black Market (foreign exchange rates).

Glamtush reports that the lingering scarcity of foreign exchange rates against naira in the country has continued to worsen even as the exchange rate on the parallel market is inching towards N590/$1.

The development, Glamtush understands, may lead to massive job loss in the manufacturing industry, among other sectors, according to the Manufacturers Association of Nigeria.

Glamtush reports that the development comes over eight months after the Central Bank of Nigeria stopped the sale of forex to Bureau de Change operators and promised to boost liquidity in commercial banks.

Checks by Glamtush on Tuesday showed that the exchange rate stood at N585/$1 and N785/£1 on the black market as against the N582/$1 last Friday.

This is just as banks have also limited customers’ access to forex, placing a cap of $20 per month for online transactions.

According to insiders, things may worsen even further as electioneering intensifies, adding that politicians had begun to mop up dollars, driving up the demand.

“The naira will keep falling because those who need dollars cannot get it and they will patronise the parallel market, increasing demand. It is also one of the fallouts of an election year. We are not earning as much FX and we will spend more financing on petrol subsidy. Ultimately, there will be a wider gap between the import and export window and the parallel market,” a government official, who craved anonymity, said.

Already, frustrated manufacturers and travellers have been forced to patronise BDC operators more often than before.

It was learnt that in some instances, banks were able to meet just about 30 per cent of customers’ demands.

“I applied for a $5,000 Business Travel Allowance through the CBN portal. But my bank said it could give me only $2,000,” said a businessman who wished to remain anonymous.

It was, however, learnt that the experiences of manufacturers were far worse.

“Never in a million years would I have thought Nigeria would get to this stage. How do you explain that a manufacturer had an invoice of $425,000 to import materials and all that is allocated to him from the CBN is $210? I can’t even wrap my brain around it,” said Bola Adefila, the Chief Operating Officer, Banrut Rolls Nig Ltd.

It was learnt that the MAN had begun reaching out to the Federal Government for urgent intervention even as the rising cost of diesel has worsened the ease of doing business.

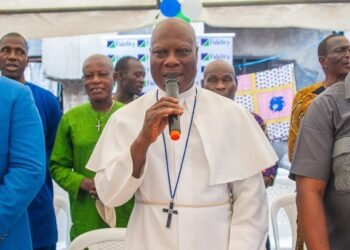

The Director-General of MAN, Segun Ajayi-Kadir, said in a chat with The PUNCH that manufacturers now rely on the parallel market for their foreign exchange.

Ajayi-Kadir said the forex scarcity and the high cost of diesel had greatly increased the cost of production, adding that employers may be forced to lay off some workers in order to cope with the new realities.

He also recommended that the northern land borders be re-opened to allow fuel marketers bring in diesel from neighbouring countries like Niger and Chad which both have functional refineries.

On the job losses, he said, “Absolutely yes. It is very difficult especially for small scale industries because if you are not producing, how will you pay salaries? So, industries might be forced to ‘right size’. That is why we are making all these consultations in order to be able to get the attention of the government.

“The scarcity of forex is also unfortunate because it affects the manufacturing sector more than others. The manufacturing sector has a multiplier effect on the economy and this sector ought to receive priority. Our members are given ridiculously low amounts in the face of huge demands.

“We need forex for materials and spare parts which are not locally available. We were encouraged when the CBN said it stopped allocation of Forex to BDCs in order to put more money in the banks but down the line, this has not happened. We got to the BDCs for more than 90 per cent of our needs. When you ask for $400,000, you are given $2,000. You ask for $1m, you are given $50,000. This is ridiculous.”

Dollar scarcity to worsen inflation

Also, economists warned that the rising cost of production due to the forex shortage would lead to inflation as businesses would be forced to hike the cost of goods. An economist and a senior lecturer of Economics at the Pan Atlantic University, Dr Olalekan Aworinde, said manufacturers would be greatly affected by the issue of dollar scarcity.

He said that this crisis would worsen inflation and negatively affect the Gross Domestic Product.

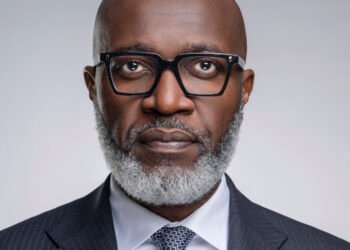

An economist and CEO of Centre for the Promotion of Private Enterprise, Dr Muda Yusuf, lamented that the country has been suffering from this issue for a while, with many manufacturers patronising the parallel market at expensive rates.

He added that this would further heighten the country’s inflation rate.

“The effect of this, first, is that many of the manufacturers have been forced to patronise the parallel market and they are getting the forex at exorbitant rates. Therefore, their costs of production have been increasing. The prices of products have been increasing.

He said, “For some products, the product quality has been declining and quantity reducing so that they can maintain the price and not inflate it much. It is putting a whole lot of pressure on the manufacturing sector and affecting their capacity to create jobs.”

A professor of Economics at the Olabisi Onabanjo University, Ago-Iwoye, Ogun State, Prof Sheriffdeen Tella, urged the CBN to intervene in order to curb the adverse effects of the dollar scarcity.

He said, “It is dangerous to our indigenous companies because they are not able to produce at an optimal level. Some people may end up getting sacked, which would increase unemployment. Eventually, the country will go back to recession. The CBN needs to intervene.”

Responding to the claims, the CBN, through its spokesperson, Osita Nwasinobi, advised those manufacturers to formally write the apex bank about their complaints.

He said, “Any manufacturer that feels that he or she is not getting adequate Forex can formally write to the CBN to communicate their complaints. As you well know these manufacturers source their Forex from banks and not from the CBN.”