Amina, a small grocery store owner in bustling Lagos, Nigeria, is the embodiment of resilience.

Her store is an essential hub in her local community, a place where neighbours can find everything from essential food items to occasional sweet treats for the children. It’s the place where Amina shares smiles and small talks with her customers while providing them with their daily needs.

However, running a small business like Amina’s is not without its challenges. One of the significant obstacles she faces is securing credit to purchase inventory.

Imagine this: it’s a bright new day, and Amina opens her shop, ready to serve her community. She is greeted by the warm smiles of her customers but also by the hard reality of her half-empty shelves. The market prices have been fluctuating, and her cash flow is strained. This is a predicament that many small business owners like Amina face – maintaining a well-stocked store while grappling with cash flow issues and market unpredictability.

Here enters inventory finance, a financial innovation that serves as a lifeline for entrepreneurs like Amina. This form of credit provides funds for purchasing inventory, acting as a steady bridge over the turbulent waters of cash flow challenges. With inventory finance, Amina can replenish her shelves without straining her finances.

Let’s picture the transformation this brings: Amina, once concerned about her dwindling inventory, now walks into her supplier’s warehouse with confidence. Thanks to a fintech firm offering inventory finance, she can purchase the items her customers need on credit. This makes her store a reliable one-stop-shop in her community. It’s like she has found a magic key that unlocks a door to endless possibilities for her business.

Inventory finance also arms Amina with a shield against the whims of market price fluctuations. As any seasoned business owner will tell you, prices can be as unpredictable as the weather. With inventory finance, Amina can buy more stock when prices are low, protecting her business from sudden price hikes. It’s a strategic move, a way to navigate the choppy waters of the market with a reliable compass.

However, the benefits of inventory finance aren’t confined to Amina alone. A thriving local business means more employment opportunities and more income circulating within the community. It’s akin to a tree planted in the heart of a community; as it grows, its roots spread, and its shade provides comfort to many.

While inventory finance is not a new concept globally, its penetration in many parts of Africa, including Nigeria, has been minimal. But this is changing. In Nigeria, for instance, innovative fintech companies have embraced the challenge, and are working tirelessly to drive the adoption of inventory finance among small business owners. These companies are the bridge connecting Amina and thousands of other business owners to the benefits of inventory finance. They have adapted a solution known globally to fit the unique challenges and opportunities of the Nigerian market, thus redefining the landscape of small business financing in the country.

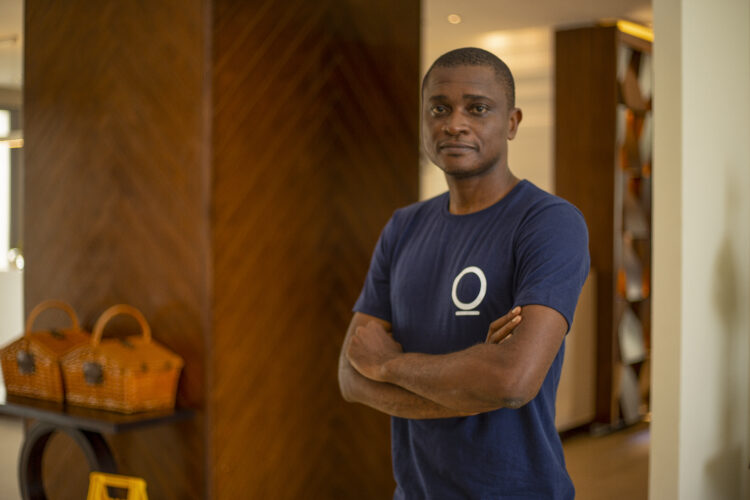

Inventory finance is more than just a financial tool; it’s a catalyst for change. It’s transforming small businesses, invigorating communities, and reshaping economies. Behind this transformation, fintech companies like OnePipe, with their Pay4Me product on the Growtrade platform are the unsung heroes, championing the cause of small businesses, one loan at a time.

So, the next time you pass by a bustling, well-stocked small shop in Nigeria, remember that behind the abundance, there’s a story of resilience, growth, and innovation. It’s a story where small business owners like Amina are the protagonists, and inventory finance is their empowering ally. This unfolding narrative holds the promise of a more prosperous and inclusive economy where every small business can truly thrive. The journey towards this promising future is underway, with every inventory financed, every shelf stocked, and every small business supported.

By Abang Emenyi, Head, Growth & Marketing, OnePipe