Zenith Bank Plc has announced its audited financial results for the year ended December 31, 2024, delivering significant growth across key performance indicators.

The Bank’s impressive performance reflects effective management and pricing of its risk assets, as well as an optimized treasury portfolio, reinforcing its position as a leader in Nigeria’s banking industry.

According to the audited financial results for the 2024 financial year presented to the Nigerian Exchange (NGX), the Bank recorded a double-digit year-on-year (YoY) growth of 86% in gross earnings, increasing from N2.13 trillion in 2023 to N3.97 trillion in 2024. This growth was driven by a 138% increase in interest income, supported by investment in high-yield government securities, and growth in the Bank’s loan book.

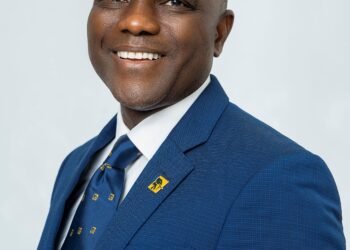

Commenting on the results, Dame Dr Adaora Umeoji OON, Group Managing Director/CEO, stated “This year’s performance underscores our unwavering commitment to innovation and customer-centric solutions. We will also remain focused on deepening financial inclusion, enhancing service delivery, and creating value for our customers and stakeholders.

Zenith Bank’s profit before tax (PBT) rose by 67%, reaching N1.3 trillion in 2024 from N796 billion in 2023, driven by a combination of top-line expansion and efficient treasury portfolio management. Net interest income increased by 135% from N736 billion in 2023 to N1.7 trillion, reinforcing the Bank’s strong core banking performance and ability to grow earnings despite macroeconomic headwinds. Non-interest income also grew by 20% from N919 billion to N1.1 trillion.

The Bank’s total assets grew by 47% from N20 trillion in 2023 to N30 trillion in 2024, underpinned by a strong liquidity position and effective balance sheet management. Customer deposits surged by 45% from N15 trillion to N22 trillion in 2024, reflecting a historically strong corporate deposits portfolio and a sustained increase in retail deposits. The increase in retail deposits was driven by customer acquisition and the Bank’s strategic focus on low-cost funding.

Return on Average Equity (ROAE) declined to 32.5% on the back of the injection of new capital, while Return on Average Assets (ROAA) remained unchanged at 4.1%. The Bank’s cost-to-income increased slightly from 36.1% to 38.9%, despite inflationary pressures. Its Non-Performing Loan (NPL) ratio stood at 4.7%, with a coverage ratio of 223%, underscoring the Bank’s prudent risk management and commitment to maintaining a resilient loan book, ensuring stability and confidence in the Bank’s operations.

Given the good earnings performance, the Bank has proposed a final dividend of N4.00 per share, which brings the total dividend for the year to N5.00 per ordinary share.

In a significant milestone, Zenith Bank successfully raised N350 billion in capital through a rights issue and public offer, with a subscription rate of 160%, demonstrating strong investor confidence in the Bank’s growth trajectory. The proceeds from this capital raise will be strategically deployed to enhance technology infrastructure, strengthen liquidity, and support the Bank’s expansion into key African markets, unlocking new growth opportunities.

The bank remains focused on delivering sustainable growth, enhancing shareholder value, and driving financial inclusion through innovative banking solutions. With its solid capital base and innovative product offerings, the Bank is well-positioned to navigate evolving market conditions while continuing to strengthen its leadership in the Nigerian financial landscape.

Zenith Bank’s track record of excellent performance has continued to earn the brand numerous awards including being recognised as the Number One Bank in Nigeria by Tier-1 Capital for the fifteenth consecutive year in the 2024 Top 1000 World Banks Ranking, published by The Banker Magazine. The Bank was also awarded the Bank of the Year (Nigeria) in The Banker’s Bank of the Year Awards for 2020, 2022 and 2024; and Best Bank in Nigeria for four times in five years, from 2020 to 2022 and in 2024, in the Global Finance World’s Best Banks Awards.

Further recognitions include Best Commercial Bank, Nigeria for four consecutive years from 2021 to 2024 in the World Finance Banking Awards and Most Sustainable Bank, Nigeria in the International Banker 2023 and 2024 Banking Awards. Additionally, Zenith Bank has been acknowledged as the Best Corporate Governance Bank, Nigeria, in the World Finance Corporate Governance Awards for 2022, 2023 and 2024 and ‘Best in Corporate Governance’ Financial Services’ Africa for four consecutive years from 2020 to 2023 by the Ethical Boardroom.

The Bank’s commitment to excellence saw it being named the Most Valuable Banking Brand in Nigeria in the Banker Magazine Top 500 Banking Brands for 2020 and 2021, Bank of the Year 2023 and 2024 at the BusinessDay Banks and Other Financial Institutions (BAFI) Awards, and Retail Bank of the Year for three consecutive years from 2020 to 2022 and in 2024 at the BAFI Awards.

The Bank also received the accolades of Best Commercial Bank, Nigeria and Best Innovation in Retail Banking, Nigeria, in the International Banker 2022 Banking Awards. Zenith Bank was also named Most Responsible Organisation in Africa, Best Company in Transparency and Reporting and Best Company in Gender Equality and Women Empowerment at the SERAS CSR Awards Africa 2024; Bank of the Year 2024 by ThisDay Newspaper; Bank of the Year 2024 by New Telegraph Newspaper; and Best in MSME Trade Finance, 2023 by Nairametrics.