Tax dialogues is crucial for strengthening tax administration, says Muhammad Nami.

Glamtush reports that tax dialogues, which provide a platform for exchange of diverse ideas on taxation, have been described as a tool for engendering tax compliance through collective ownership of the tax system, as well as a means to strengthening tax systems.

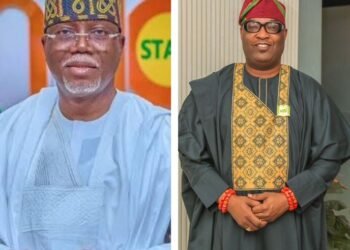

Speaking at the 2022 Kaduna State Tax Dialogue, held in Kaduna State today, Mr. Muhammad Nami, Executive Chairman of the Federal Inland Revenue Service (FIRS) stated that dialoguing on tax was very necessary for inclusivity, fairness and pooling expert ideas to aid tax policy formulation, which ultimately strengthens tax administration.

“Dialoguing on tax is very important for many reasons,” he stated.

“Tax dialogue is a multi-sided communication channel that enables every view to taxation be aired and considered. By so doing, it lends itself to inclusiveness in the design and implementation of the tax system thereby engendering the spirit of collective ownership which, ultimately, promotes voluntary tax compliance.

“Dialoguing on tax prevents destructive conflicts as no one feels cheated or unfairly treated.

“Examples from history are rife on the importance of engagements on tax issues. For instance, the then British Parliament passed the Tea Act which constrained Americans to buy tea on which duty had been paid without dialoguing with the people. Consequently, the Act was rejected. According to Richard Murphy, in his book — the “Joy of Tax” —, one of the complaints cited by those who signed the Declaration of Independence in 1776 was ‘The King which was imposing taxes on us without our Consent.’

“When governments do not dialogue with the people on the taxes they wish to impose, they create room for conflict and even rebuff.

“Crucially, tax dialogue provides the platform for pooling expert ideas to aid tax policy formulation, review of tax laws and ultimately the strengthening of tax administration,” Mr. Nami said.

Speaking on the concept of the “Social Contract” that exists between the government and the citizens, Mr. Nami explained that for the government to provide public goods for the enjoyment of citizens, citizens had the duty to provide government with the needed resources to do so by paying their taxes.

“As much as individuals running the apparatus of government are liable to satisfy the yearnings of citizens for public goods, it is the duty of the citizens to supply the resources required. This is the Social Contract.

“The Social Contract is two-sided – it involves the duty of government to provide public goods for the enjoyment of citizens on the one hand; and the duty of citizens to provide government with the resources needed to provide those public goods on the other hand. Citizens fulfil their side of the Social Contract by paying taxes with minimal prompting.”

Mr. Nami further noted that two key drivers of voluntary tax compliance are effective communication and trust, and that “Tax Authorities must develop effective tax communications strategies while governments, at all levels, must ensure taxpayers receive value for taxes paid.”

The FIRS boss further called on tax authorities to implement data-driven tax administrations, noting that “modern and efficient tax administration is run with data.”

“The time is ripe for Nigerian tax authorities to start using data to identify all taxable persons, track all economic activities and determine tax payable.

“Nigeria needs appropriate statutory framework for a centralised data sourcing, warehousing, analysis and retrieval system that every tax authority can plug into.”

Muhammad Nami also called for the harmonisation, at all levels of government, of all revenue generating functions into a single platform under the administration of one revenue authority to reduce cases of uncertainty and instability in the economy.