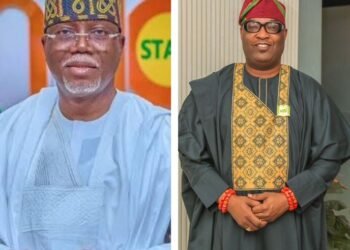

FIRS Chair, Zacch Adedeji has explained how the proposed tax reforms will address the current imbalance.

Glamtush reports that the FIRS Chairman explained that the current VAT sharing arrangement primarily benefits Lagos, the FCT, and Rivers—states where most corporate head offices are located.

He further noted that the proposed reforms aim to address this imbalance by introducing a derivation principle model, ensuring a more equitable distribution of VAT revenues to all states, regardless of their economic status.

Today, I just reeled out of the data on this month of October sharing. I just signed it in on Friday. Today, Lagos will take 42% of the VAT. Rivers will take 16%. Oyo State will take 5.2%, FCT will take 9%. If you take those 3 States, they are taking more than 70% of the tax.

“Why? Because those are the places where the head offices of those places are. And we know that 70% of consumption is not happening in those three states.

So in whatever way you look at it, there is no way every other state apart from Lagos, Rivers, FCT, benefits from the proposed tax bill.

“If you look at it, MTN contributed highest, but because MTN headquarters is in Lagos, all the allocation from MTN is being accrued to Lagos. So, when this bill is passed, all states will benefit irrespective of the kind of economic situation that is happening in Nigeria,” Adedeji said.

Derivation Principle for Consumption Tax

In addition, the FIRS Chairman clarified that the derivation principle model applies specifically to consumption tax or Value Added Tax (VAT).

In his address, Adedeji emphasized that this model should not be mistaken for the derivation principle applied to oil-producing states, which is based on the location of production.

He explained that, in the case of consumption tax, derivation means the funds will be allocated to the states where the commodity is consumed, rather than the states where corporate head offices are situated.

“On derivation, I see there is a mix-up here. We have the oil and gas. If you look at the oil and gas, where they produce is where we sell and collect money from the oil. That’s why it is limited to their States.

“VAT by definition is a consumption tax. If you use derivation in VAT, what it means is that where is it consumed. Where do you make the call? Where is the bank transaction done? What the bill seeks to correct is that the existing structure we have does not represent the intent of Nigeria,” Adedeji added.

What you should know

The new tax bills under consideration in the National Assembly propose adopting a derivation principle in the allocation of VAT revenues between the federal government and sub-national entities.

These proposals have sparked controversy, with northern elites openly rejecting them, arguing that the changes may not favor their region.

Under the current Section 40 of the VAT Act, VAT revenue is allocated as follows: 15% to the Federal Government, 50% to the States and Federal Capital Territory (FCT), and 35% to Local Governments. The allocation to states and local governments incorporates a derivation principle of at least 20%.

Although not explicitly detailed in the VAT Act, other factors influencing the distribution include 50% based on equality and 30% based on population.

Additionally, 4% of collections are allocated to the Federal Inland Revenue Service (FIRS) as a collection fee, while 2% goes to the Nigeria Customs Service (NCS) for import VAT.