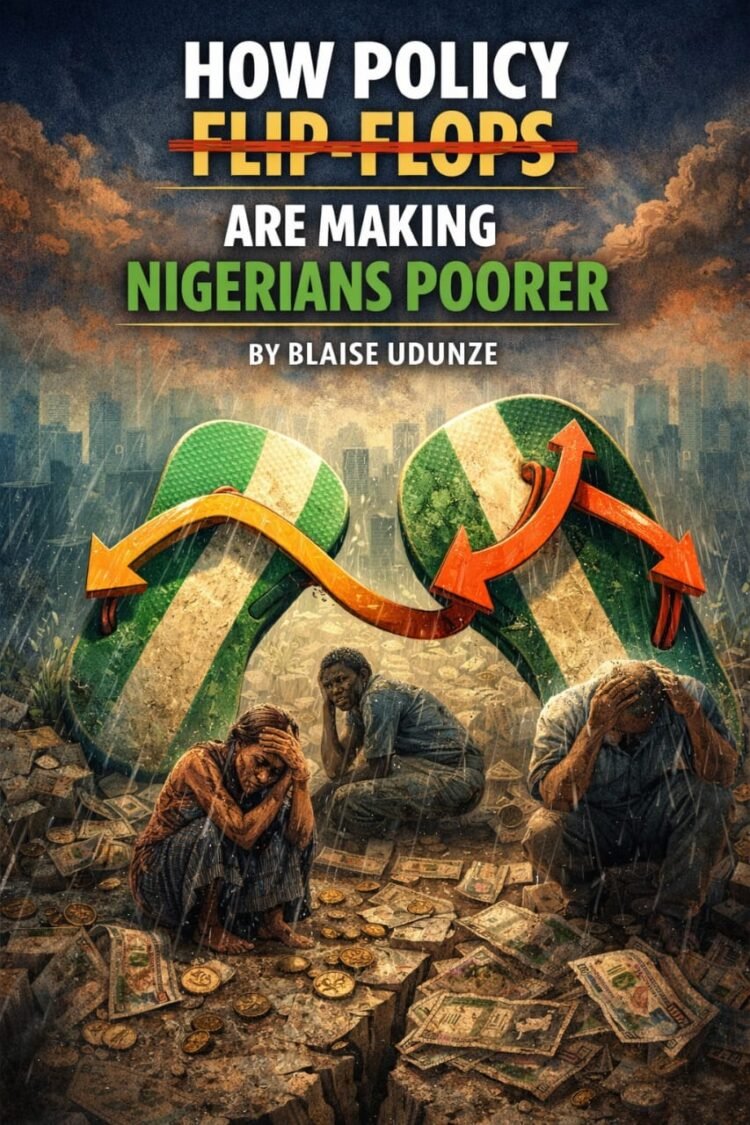

Nigeria’s deepening poverty crisis is no longer speculative; it is now statistically inevitable.

Although the latest Consumer Price Index figures released by the National Bureau of Statistics (NBS) suggest that headline inflation is cooling and growth indicators show tentative improvement, regrettably, more Nigerians are slipping below the poverty line.

Reviewing the recent projections from PwC’s Nigeria Economic Outlook 2026, it is alarming, which reveals that no fewer than two million additional Nigerians are expected to fall into poverty next year. This is expected to push the total number of poor people to about 141 million, roughly 62 percent of the population and the highest level ever recorded in the country’s history.

This grim outlook persists despite eight consecutive months of easing inflation and modest economic recovery, and as one can perceive, the contradiction is telling. The fact remains that macroeconomic signals are improving on paper, yet lived reality continues to deteriorate. It is glaring that the widening gap between policy metrics and human outcomes exposes a deeper truth in the sense that Nigeria’s poverty crisis is not simply the product of external shocks or temporary adjustment pains. It is the cumulative result of fragile policymaking, inconsistent reforms, weak institutional coordination, and a failure to sequence economic changes with adequate social protection. With these, it becomes clearer that poverty in Nigeria is no longer an unintended side effect of reform; it is increasingly its most visible outcome as identified today.

It would be recalled that the current administration in 2023, when it assumed office, promised a bold economic reset. At this point, the nation witnessed the fuel subsidy removal, exchange-rate liberalisation, and tighter fiscal discipline being introduced swiftly and applauded internationally for their courage and long-term logic. Notably, these reforms unleashed an economic storm whose aftershocks continue to batter households and currently resulting to the cost of a bag of rice that sold for about N35,000 two years ago now costs between N65,000 and N80,000, while a crate of eggs has risen from N1,200 to over N6,000 and basic staples like garri, tomatoes, and pepper have drifted beyond the reach of ordinary Nigerians. For millions, the economy did not reset; it snapped.

Inflation, often described by economists as a “silent tax,” has punished productivity, mocked thrift, and rewarded speculation.

Reports from the NBS’s December 2025 disclosed that headline inflation eased to 15.15 percent and according to it, this is due to a rebasing of the Consumer Price Index, down sharply from 34.8 percent a year earlier, this statistical moderation has brought little relief to households. Food inflation, at 10.84 percent year-on-year, and a marginal month-on-month decline may look reassuring on spreadsheets, but for families spending 70 to 80 percent of their income on food, such figures feel detached from reality. These figures are not only implausible but also insulting to those whose lives have been torn apart by the skyrocketing prices. With the realities facing the larger populace, Nigeria must be using another mathematics.

Nigeria may have changed its base year, but it has not changed the harsh arithmetic of survival.

PwC’s data underscores this disconnect, as nominal household spending rose by nearly 20 percent in 2025, real household spending contracted by 2.5 percent, reflecting the erosive impact of rising food, transport, and energy costs. The painful part of it, is that Nigerians are spending more money to consume less, and this is to say that growth, hovering around 4 percent, is not strong enough to absorb shocks or lift households meaningfully. As analysts note, Nigeria would require sustained growth of 7 to 9 percent to make a significant dent in poverty. That is to say that anything less merely slows the descent.

The structural weakness of the economy is compounded by policy inconsistency. Nigeria’s economic landscape is littered with abrupt shifts, subsidy removals without buffers, currency reforms without stabilisation mechanisms and trade policies that oscillate between restriction and openness. For households and small businesses, which employ most Nigerians, this unpredictability makes planning impossible. The economy has constantly being faced with price volatility, income shocks, and lost jobs because these are the ripple effects of every policy reversal. Uncertainty itself has become a poverty multiplier.

Nowhere is this fragility more evident than in food systems and rural livelihoods, and this has been where insecurity has merged with policy failure to create a new poverty spiral. Across farmlands in the North and Middle Belt, crops rot unharvested as banditry and insurgency force farmers off their land. Nigeria’s largely agrarian economy has been crippled by violence that disrupts planting cycles, destroys infrastructure, and displaces communities. The result is both income poverty for farmers denied access to their livelihoods and food inflation that erodes purchasing power nationwide.

For record purposes, earlier last year, the NBS Multidimensional Poverty Index showed that 63 percent of Nigerians, about 133 million people, are multidimensionally poor, with poverty heavily concentrated in insecure regions. Findings showed that about 86 million of the poor live in the North, and this is where insecurity is most severe. This record showed that rural poverty stands at 72 percent,c compared to 42 percent in urban areas, and while the states most affected by banditry and insurgency record poverty rates as high as 91 percent. Insecurity is no longer just a security problem; it is one of Nigeria’s most powerful poverty drivers.

The economic cost of insecurity in Nigeria today is staggering. This is because the conservative estimates suggest Nigeria loses about $15 billion annually, which is roughly equivalent to N20 trillion, due to insecurity-induced disruptions across agriculture, trade, manufacturing, and transportation. At the same time, security spending now consumes up to a quarter of the federal budget. In just three years, over N4 trillion has been spent on security, which crowded out investment in health, education, power, and infrastructure. Every naira spent managing perpetual violence is a naira not invested in preventing poverty, even as poverty deepens, the state’s fiscal response reveals a troubling misalignment of priorities. The 2026 federal budget, estimated at N58.47 trillion, ironically allocates just N206.5 billion to projects directly tagged as poverty alleviation and this only amounts to about 0.35 percent of total spending and less than one percent of the capital budget. In a country where over 60 percent of citizens live below the poverty line, this allocation borders on policy negligence.

Worse still, over 96 percent of this already meagre poverty envelope sits under the Service Wide Vote through the National Poverty Reduction with Growth Strategy, largely as recurrent provisions. All ministries, departments, and agencies combined account for barely N6.5 billion in poverty-related projects. This fragmentation reflects a deeper institutional failure, that is to say, poverty reduction exists more as a line item than as a coherent national mission.

Where MDA-level interventions exist, they are largely palliative and scattered, grain distribution in select communities, tricycles and motorcycles for empowerment, and small scale skills acquisition for women and youths.

The largest such project, a N2.87 billion tricycle and motorcycle scheme under a federal cooperative college, accounts for nearly half of all MDA-based poverty spending. The fact remains that the various interventions may offer temporary relief, and they do little to address structural drivers of poverty such as job creation, productivity, market access and human capital development.

Even the Ministry of Humanitarian Affairs and Poverty Alleviation illustrates the problem just as its budget jumped sharply in 2026, much of the increase went into administrative and capital items, office furniture, equipment, international travel, retreats, and systems automation rather than direct poverty-fighting programmes. This reflects a familiar Nigerian paradox: institutions grow, but impact shrinks.

International partners have been blunt in their assessments. The World Bank estimates that Nigeria spends just 0.14 percent of GDP on social protection, which is far below the global and regional averages. Only 44 percent of safety-net benefits actually reach the poor, rendering the system inefficient and largely ineffective. PwC similarly warns that without targeted job creation, productivity-focused reforms, and effective social protection, poverty will continue to rise, undermining domestic consumption and straining public finances further.

Fiscal fragility compounds the crisis. The N58.18 trillion 2026 budget carries a deficit of N23.85 trillion, with debt servicing projected at N15.52 trillion, nearly half of expected revenue. The public debt has ballooned to over N152 trillion. The contradiction here is that Nigeria is borrowing not to expand productive capacity but to keep the machinery of government running. The truth is not far-fetched because, as debt crowds out development spending, households are forced to pay privately for public goods, education, healthcare, water, deepening inequality and entrenching poverty across generations.

To be clear, not all signals are negative. This is because opportunities exist if reforms are sustained and properly sequenced. Regional trade under the African Continental Free Trade Area could diversify exports and create jobs. But reform momentum without inclusion and institutional capacity risks becoming another missed opportunity.

This is the central tragedy of Nigeria’s moment. The country is attempting necessary reforms in an environment of weak buffers, fragile institutions, and low trust. Poverty is therefore not accidental. It is the predictable outcome of inconsistency, reforms without protection, stabilisation without security, and budgets without people.

Nigeria faces an undeniable choice. It can continue down a path where fragile policies deepen deprivation and erode trust, or it can build a disciplined, coordinated framework that aligns reforms with social protection, security, and inclusive growth. Poverty is not destiny. But escaping it requires more than courage in reform announcements; it demands consistency, compassion, and the political will to place human welfare at the centre of economic strategy.

Blaise Udunze, a journalist and PR professional, writes from Lagos and can be reached via: blaise.udunze@gmail.com