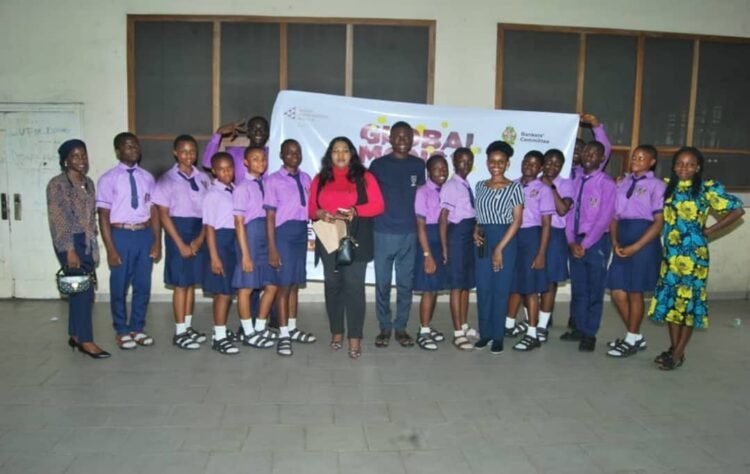

In celebration of the 2025 edition of Global Money Week (GMW), Polaris Bank took its financial literacy advocacy to NANA College, Warri, Delta State, where students received firsthand insights on money management, saving, and investing.

The event, held within the school premises, witnessed an impactful engagement led by Mr. Andrew Komori, the Group Head of Polaris Bank, who represented the MD/CEO at the event. Addressing a hall packed with enthusiastic students and faculty members, Mr. Komori delivered a compelling lecture on financial literacy, emphasizing its critical role in shaping a secure and prosperous future.

He explained that financial literacy is not just about knowing how to spend money, but understanding how to make informed decisions, avoid debt traps, and build long-term wealth.

According to him, “Financial literacy empowers you to take control of your future. It is a life skill that helps you plan, protect, and grow your money wisely.” One of the highlights of the session was Mr. Komori’s explanation of the fundamental difference between saving and investing.

Using relatable examples, he illustrated that saving involves setting money aside for short-term needs or emergencies, often in a bank account, while investing is the act of putting money into vehicles like stocks, mutual funds, or businesses with the expectation of generating returns over time. He urged the students to develop both habits early, noting that each plays a vital role in achieving financial stability.

He further emphasized that saving is important, but investing is what will set individuals up for long-term financial success. Mr. Komori also stated that achieving financial freedom requires a combination of earning, saving, and smart investing.

The event was designed to be engaging and participatory. Following the lecture, there was a highly interactive session where students eagerly asked questions and shared personal experiences. The facilitator responded with clarity and encouragement, helping the students understand real-life applications of the financial principles discussed.

The vibrant interaction underscored the curiosity and readiness of young Nigerians to learn about money and how it works. Both the faculty and students expressed their gratitude to Polaris Bank for the impactful session.

Mrs. Madamedon, the Principal of NANA College, thanked Polaris Bank for facilitating the event, saying, “On behalf of the entire school, I would like to extend our heartfelt appreciation to Polaris Bank for investing in the future of our students. This session has equipped them with vital skills that will serve them throughout their lives. Financial literacy is key to success, and we are grateful to be a part of this initiative.”

Mrs. Onakufe, the Vice Principal, also expressed her gratitude, adding, “We are excited that Polaris Bank chose our school for this important event. The knowledge shared today has already sparked conversations among our students, and we believe this will have a lasting impact on their financial decision-making as they grow into adulthood.”

In addition to NANA College, Polaris Bank also visited several other schools across Nigeria, including Excel International School, Damaturu, Baptist High School, Ede, Christ the King Excellent Academy, Lokoja, and Graceland International School, Ogotun Ekiti with a mandate to visit at least one school in each state.

These sessions have helped extend the Bank’s financial literacy outreach to a larger group of students. The students also shared their excitement, describing the session as “eye-opening” and “life-changing.”

Polaris Bank continues to demonstrate its commitment to youth empowerment through various financial literacy initiatives targeted at secondary schools and higher institutions across Nigeria. The Bank believes that a financially literate population begins with equipping the youth with the tools they need to make smart financial decisions.