GTCO shareholders have approved N8.03 per share dividend payout.

Glamtush reports that shareholders of Guaranty Trust Holding Company (GTCO) Plc have approved the payment of a total dividend of N8.03 per share for the financial year ending December 31, 2024.

This decision was taken at the company’s fourth annual general meeting, which was held virtually yesterday. The company had previously paid an interim dividend of N1 per share, and would now make an additional N7.03 per share bringing the total dividend for the 2024 financial year to N8.03 per share.

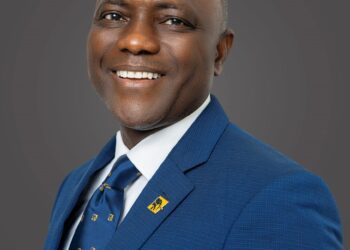

Speaking to shareholders, the chairman of GTCO, Mr Hezekiah Sola Oyinlola, emphasized the group’s ability to remain agile and forward-thinking, which has allowed the company to achieve record-breaking performances.

Oyinlola in his address at the AGM stated that, “In 2024, we became the first Nigerian bank to surpass the N1 trillion profit mark, an achievement that underscores the resilience of our business model, the dedication of our people, and the trust our customers place in us.”

According to him, the company’s success in a changing macroeconomic landscape is built on three pillars: operational excellence, disciplined risk management, and a relentless focus on customer-centric innovation. He noted that the banking business continues to demonstrate strong fundamentals, supported by a robust capital base and effective cost management.

“Our strategic diversification into payments, asset management, and pension fund administration has provided complementary revenue streams, reinforcing our leadership in the financial services sector,” he added.

Also speaking on the group’s 2024 performance, the Group Chief Executive Officer of GTCO, Mr. Segun Agbaje noted that, “In 2024, we reached a historic milestone, delivering over N1 trillion in profit before tax, becoming the first Nigerian financial institution to achieve this feat.”

He emphasized that its banking subsidiary, Guaranty Trust Bank remains central to its operations, driving growth in Nigeria, West Africa, East Africa, and the United Kingdom.

“In 2024, we navigated a rapidly evolving regulatory and macroeconomic environment with a focus on strengthening our financial position and delivering best-in-class banking services,” he explained.

Agbaje also noted that the Central Bank of Nigeria’s recapitalization policy presented an opportunity to reinforce market leadership, allowing the group to complete the first phase of its equity capital raising plan through a Public Offer.

“This Public Offer attracted strong participation from both domestic retail and institutional investors, raising N209.41 billion and expanding our shareholder base from 332,000 to over 460,000,” he added.

“With this momentum, we are prepared to launch the second phase of our capital raising plan in 2025, targeting significant foreign institutional investments to further solidify our reputation as a globally recognized and competitive financial services brand,” he added.

Looking ahead, Agbaje stated, “Our focus will be on deepening digitalization, enhancing customer experiences, and expanding our ecosystem of financial and non-financial solutions. We will continue to invest in cutting-edge technology, strengthening our cybersecurity framework, and building strategic partnerships that unlock new growth opportunities. Most importantly, we will remain true to our purpose: driving economic progress, fostering financial inclusion, and creating sustainable value for all stakeholders.”

Shareholders commended the board for the financial performance achieved during the reviewed period, despite the challenging operating environment.

Chief Timothy Adesiyan, speaking on behalf of shareholders, praised the management of GTCO for their impressive financial performance in 2024 and the dividend payout.

Also, Mrs. Bisi Bakara, national coordinator of the Pragmatic Shareholders Association of Nigeria, commended the board, management, and staff for their stellar performance and success in the face of adversity. She expressed approval for the proposed final dividend declaration of N7.03 per share, which totals N8.03 in dividend payments.

For the year ended December 31, 2024, GTCO reported a remarkable 81.1 per cent surge in gross earnings, reaching N2.15 trillion, up from N1.19 trillion in 2023.

Oyinlola before the end of the AGM also announced that as part of the company’s succession plan, Mr Suleiman Barau has been appointed as the new Group Chairman, pending regulatory approval.

He highlighted Barau’s extensive experience and respect in the industry, noting that “he is a former Deputy Governor of the Central Bank of Nigeria, with a proven track record of leadership and strategic insight.

“He has been a pioneering director of GTCO since its restructuring. I am confident that under his guidance, GTCO will continue to thrive, innovate, and deliver superior value to all its customers and stakeholders,” he stated.