FIRS has expanded its tax net with 170,000 new taxpayers.

Glamtush reports that the Federal Inland Revenue Service (FIRS), said it has expanded the country’s tax net with the capturing of more than 170,000 new taxpayers through the introduction of new business modules and simplifying tax payment processes.

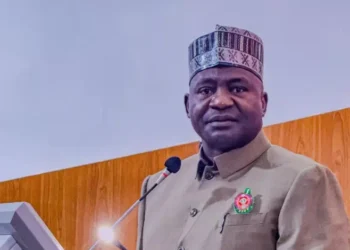

This online news platform understands that the Executive Chairman of FIRS, Dr. Zacch Adedeji, who disclosed this at a media chat in Lagos, noted that the agency recorded a 56 percent, year-on-year (YoY), increase in revenue collection to N3.94 trillion in the first quarter of 2024 (Q1’24) compared to the N2.52 trillion collected in Q1’23.

Represented by the Special Adviser on Tax Policy, Femi Olarinde, he noted that FIRS achieved 81 percent of its Q1’24 target.

He stated: “In 2023 FIRS had a target of 11.5 trillion, beyond that target, we were able to surpass it and we achieved N12.3 trillion collections.

“In 2024, the government has given us a target of N19.4 trillion, and by the end of Q1’24, we had collected 81 percent of the target for the quarter.

“Tax is somehow, we have the peak period and the off peak period. Q1 is one of the off peak periods. We are going to do better, June is the peak period and we are certain to go beyond Q2 target.”

He attributed the 107 percent revenue target achieved in 2023 to hard work and innovations.

“This is by sheer hard work, by making things right, and by making things easy for Nigerians. One of the principles of taxation is making it as convenient as possible to reduce the cost of compliance.

“Government cannot function without taxes, so the government needs strong institutions like the FIRS, to be able to contribute to the government and bring that desired infrastructure that the citizens talk about.

“We integrated nine new modules on our novel technology called the Tax Promax, it is a technology we use to administer tax. Was designed that technology in house because we encourage innovation.

“Within one year we expanded that module with nine other modules because of the drastic investment in innovation. We are revolutionalising tax office into the streamlined one stop shop; it reduces the cost of administration and reduces cost of compliance. We have improved customers satisfaction by over 70 percent.

“We achieved remarkable success in simplifying tax processes and we have increased new tax payers by 170,000,” he said.

Earlier, Special Adviser to FIRS on Media, Dare Adekanbi, said, “We cannot talk about nation building without revenue; it is the oil that keeps the economy going”