Glamtush reports that the Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) has hiked the benchmark interest rate by 200 basis points to 24.75 percent.

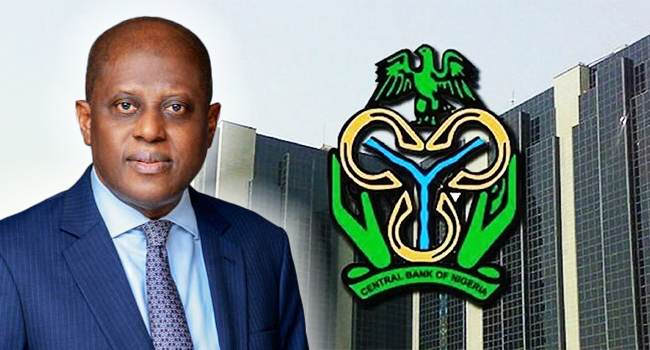

This online news platform understands that this is according to a Tuesday communique by the CBN governor Yemi Cardoso after the second MPC meeting of his tenure in Abuja.

The new interest rate is a jump from the 22.75 percent announced by the MPC about a month ago and the second rate hike by the current committee.

Cardoso announced the retention of the Cash Reserve Ratio (CRR) of deposit money banks at 45 percent. However, the MPC adjusted the CRR of merchant banks from 10 percent to 14 percent.

The committee also retained the liquidity ratio at 30 percent.

“The considerations of the committee at this meeting focused on the current inflationary pressures and the need to anchor inflation expectations as well as ensure sustained exchange stability,” the CBN chief said.

He said the moves are part of efforts to combat the country’s rising inflationary rate which was pegged at 31.70 percent in February.

Cardoso noted that MPC members believe the headline inflation in the country is triggered mostly by a hike in the cost of food.

“The committee therefore was of the view that addressing food insecurity is key to containing the current inflationary pressures,” he said while commending the Federal Government’s efforts at curbing food insecurity including the distribution of palliatives.

Tuesday’s MPC decision came amid the Nigerian authorities’ clampdown on cryptocurrency platform Binance.

Some Binance executives were detained in the country but one of them recently escaped from custody.

But while providing an update about Nigeria’s clampdown on the crypto platform, he said the CBN’s collaboration with other government agencies is yielding results.

“We consider ourselves as having the wherewithal to collaborate with other agencies of government and that is a very important function for us. About a month ago, we actually did have collaboration with law enforcement agencies, EFCC, the SEC, and other regulatory bodies as well, and what came out of that, is a work in progress, but very positive as far as I can say,” he said.

“The NSA, we’ve been sharing information together. However, in this particular case, the responsibility for regulating cryptocurrency is not our role, it isn’t ours; it is strictly that of the Security and Exchange Commission, not our responsibility.”

The next MPC meeting will be held between the 20th and 21st of May, 2024.

Check out Star Life’s Jhanak teasers June 2025 below. Check out Jhanak teasers June 2025. …

The 2027 presidential election in Nigeria is shaping up to be a crucial contest between…

Star Life’s new series, Soulmates teasers June 2025 can be accessed on this online news platform.…

Access Bank Plc and KCB Group have completed the National Bank of Kenya (NBK) transaction.…

Buzz&Bants Africa is set to launch the TrashToArt campaign on World Environment Day 2025. …

The phrase "Who will bell the cat?" originates from a medieval fable about mice who…