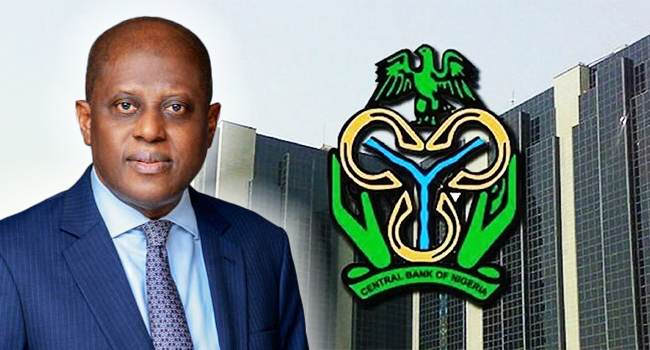

CBN has ordered banks to sell excess dollars in 24 hours.

Glamtush reports that the Central Bank of Nigeria (CBN) has ordered Deposit Money Banks (DMBs) to sell their excess dollar stock latest today, February 1, as part of moves to stabilise the nation’s volatile exchange rate.

In a new circular released on Wednesday, the apex bank also warned lenders against hoarding excess foreign currencies for profit.

Titled, “Harmonisation of Reporting Requirements on Foreign Currency Exposures of Banks”, the apex bank raised concerns over the growing trend of banks holding large foreign currency positions. The move comes barely 48 hours after the CBN released a circular, warning banks and FX dealers against reporting false exchange rates, among others.

In its latest circular, the apex bank accused banks of holding excess foreign exchange positions. It gave lenders until February 1, 2024 (today) to sell off excess dollar in their vault.

The circulated, dated January 31, 2024, was signed by the Director, Trade and Exchange, CBN, Dr. Hassan Mahmud, and representative of the Director, Banking Supervision, CBN, Mrs. Rita Sike.

“The Central Bank of Nigeria has noted with concern the growth in foreign currency exposures of banks through their Net Open Position (NOP). This has created an incentive for banks to hold excess long foreign currency positions, which exposes banks to foreign exchange and other risks,” the circular read.

The CBN also issued prudential requirements that banks must follow. A key focus of these requirements is the management of the Net Open Position (NOP) which measures the difference between a bank’s foreign currency assets (what it owns in foreign currencies) and its foreign currency liabilities (what it owes in foreign currencies).

The circular mandates that the NOP must not exceed 20 per cent short or 0 per cent long of the bank’s shareholders’ funds.

According to the apex bank, this calculation must be done using the Gross Aggregate Method, which provides a comprehensive view of the bank’s foreign currency exposure.

Furthermore, banks with current NOPs exceeding these limits are required to adjust their positions to comply with the new regulations by February 1, 2024.

Additionally, banks must calculate their daily and monthly NOP and Foreign Currency Trading Position (FCT) using specific templates provided by the CBN.