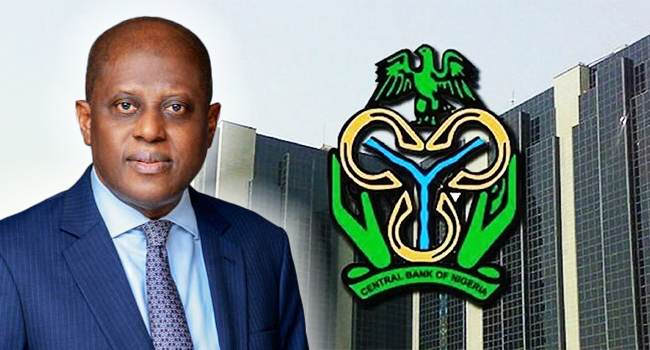

Glamtush reports that the Central Bank of Nigeria (CBN) has sacked the boards of Union Bank, Polaris Bank, Keystone Bank and Titan Trust Bank.

This online newspaper understands that the apex bank in a statement signed by its Acting Director of Corporate Communications, Sidi Hakama, said “this action became necessary due to the non-compliance of these banks and their respective boards with the provisions of Section 12(c), (f), (g), (h) of Banks and Other Financial Institutions Act, 2020.”

It added that “the Bank’s infractions vary from regulatory non-compliance, corporate governance failure, disregarding the conditions under which their licenses were granted, and involvement in activities that pose a threat to financial stability, among others.”

The CBN also assured the public of the safety and security of depositors’ funds, saying it remained resolute in fulfilling its mandate to uphold a safe, sound, and robust financial system in Nigeria.

The boards of directors and chief executives of the banks were invited to a meeting on Wednesday, January 10 where they were addressed for 30 minutes each by the apex bank’s Deputy Governor in charge of Financial System Stability, Phillip Ikeazor.

Three other governors formed the panel that addressed the bank executives. They include the Deputy Governor in charge of Operations, Emem Usoro, the Deputy Governor in charge of Economic Policy, Muhammad Abdullahi and the Deputy Governor in charge of Corporate Services, Bala Bello.

The panel reeled out issues of non-compliance and other infractions committed by the affected banks and then formally sacked the boards.

This followed the recent report of the Special Investigator on Central Bank of Nigeria (CBN) and Related entities, Jim Obazee.

Earlier, the special investigator appointed by President Bola Tinubu, invited the investors in Titan Trust Bank, but they reportedly refused to honour the invitation to a meeting with the Special Investigator.

See the full statement below:

CBN Dissolves the Board and Management of Union Bank, Keystone Bank and Polaris Bank

The Central Bank of Nigeria (CBN) has dissolved the Board and Management of Union Bank, Keystone Bank, and Polaris Bank.

This action became necessary due to the non-compliance of these banks and their respective boards with the provisions of Section 12(c), (f), (g), (h) of Banks and Other Financial Institutions Act, 2020. The Bank’s infractions vary from regulatory non-compliance, corporate governance failure, disregarding the conditions under which their licenses were granted, and involvement in activities that pose a threat to financial stability, among others.

The CBN assures the public of the safety and security of depositors’ funds and remains resolute in fulfilling its mandate to uphold a safe, sound, and robust financial system in Nigeria. Our Banking system remains strong and resilient.

Sidi Ali, Hakama (Mrs.)

Ag. Director, Corporate Communications

Nollywood actress Lilian Afegbai looks breathtaking in emeralds for Cannes 2025. Her stunning floor-length evening…

Gunmen have killed a lawyer and his client after a court session in Anambra. …

President Tinubu will be attending Pope Leo XIV’s inauguration. Glamtush reports that President…

Zoho Corporation, a global technology company, has expanded its customer experience (CX) platform with powerful…

VeryDarkMan has been re-arraigned over alleged cyberbullying of Iyabo Ojo, Tonto Dikeh, and Samklef. …

In a dynamic and often unpredictable financial landscape like Nigeria, the ability to access funds…