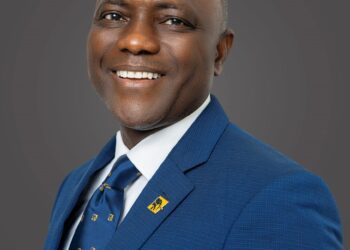

A consultant, Dr Boniface Chizea, said the activity of Bureau De Change operators is frustrating the growth of the Naira against foreign currencies.

Naira recorded an appreciable rise against the dollar in the parallel market, standing at 730/$ from 900/$ a week ago.

Speaking in a chat with Daily Post on Friday while reacting to the latest Naira rise against the Dollar, Chizea said the operation of some BDC is a significant blow to the country’s local currency.

He disclosed that the Nation’s economy benefits nothing from the activities of BDC operators.

He said the noticeable growth in the Naira after the clampdown on some unscrupulous BDC operators has shown that the government’s action is yielding results and is suitable for the sanity of the foreign exchange market.

He said that the Central Bank of Nigeria, CBN, should avoid fluctuations in the foreign exchange rates to sustain Naira growth.

“The news about the appreciation of the rate of exchange at the parallel market is the best news for the economy as it should impact on the inflationary spiral in the country, amongst other positive developments. The rates are reported to have fallen to 700 Naira plus from a high of almost 900! I also feel vindicated because I had made the recommendation that if it was at all possible that some dollars should be injected into the parallel market to checkmate the free fall in the exchange rate which the Naira was going through. And this is in writing and could be corroborated.

“I made this recommendation mindful of the fact that the heightened demand pressure was due to a sudden and intensified flight to the dollar as a store of value by primarily those who are holding piles of Naira outside the banking system illegitimately. There is, therefore, the expectation that demand pressure will stabilize post the January 31, 2023, deadline for old currency notes in the specified denominations to cease to be legal tender currency.

“It is a fact that the Central Bank is on record to have alerted us all to the fact that it does not recognize the parallel market because it is an illegal market and that also in its book, the market is lacking in depth. I have had individuals come back on this score to argue that the parallel market is even deeper than the official market as that is the market patronised by most economic agents in the Nigerian economy.

“But what is more important from where I stand is that we must not play the Ostrich in the greater interest of the Nigerian economy. Because as the spread between the official and parallel market rates widens, to that extent will, the temptation to round trip becomes almost irresistible as individuals reap bountifully without adding any iota to the level of productivity in the economy.

“What has happened now that the Naira has appreciated considerably is that some of the dealers will for a change, have their fingers burnt. It has been hitherto fairly risk-free to hedge a bet on the Naira. If it has happened now that we have witnessed this appreciation and people incur losses, that should impose some caution and return some sanity as not many operators can hold on to dollars for long periods of time because of its cost implications.

“We also learnt the security agents did a good job of arresting some of the unscrupulous ones amongst us for the undertaking of illegal transactions in this respect. We must invite them to stay the course as no option should be off the table for us to return sustained sanity to the foreign exchange market to commence the process of underwriting macroeconomic stability. Yes we agree that currency change is not the silver bullet that will solve all the problems of the Nigerian economy. But it should provide an impactful complementary antidote for the cure of this cankerworm to our body polity. The challenge going forward now is how to avoid wild fluctuations in rates which would be destabilising to say the obvious,” he stated.