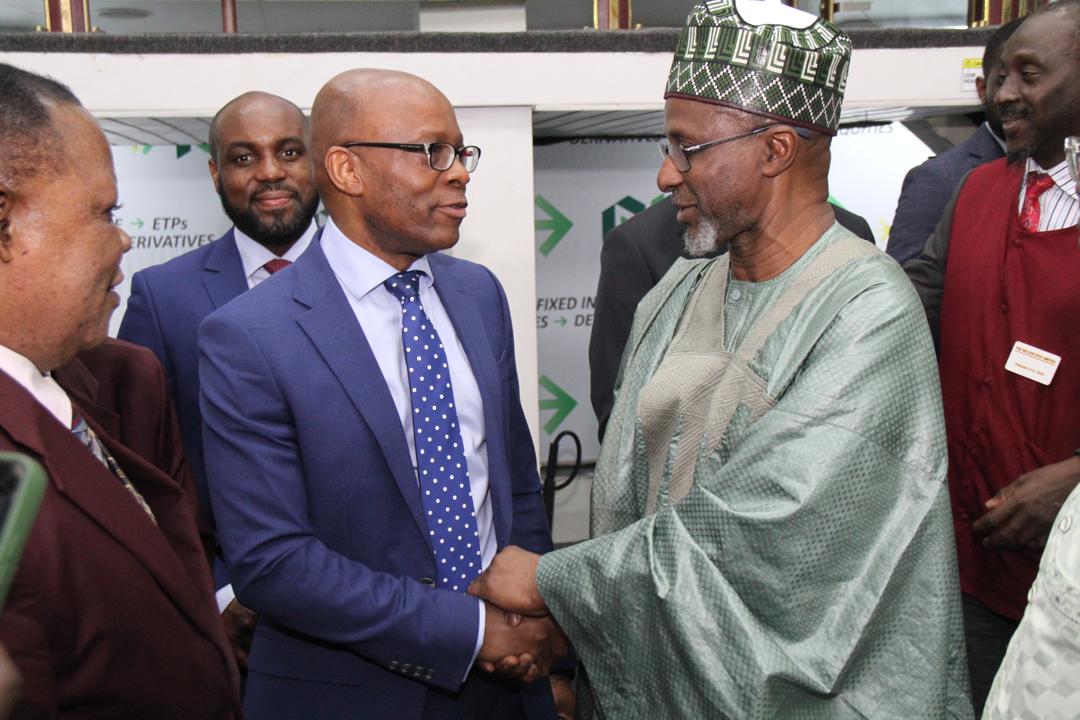

Access Bank joined NGX to launch the Impact Board.

Glamtush reports that Access Bank Plc, Nigeria’s leading institution in sustainable finance, was one of the participants in the launch of the Nigerian Exchange Limited (NGX) Impact Board, a dedicated platform for listing sustainability instruments to integrate sustainability into the core of Nigeria’s capital market.

The event, marked by the attendance of high-profile stakeholders, including the Minister of Environment, Balarabe Lawal, and the Director-General of the Securities and Exchange Commission (SEC), Dr. Emomotimi Agama, underscored the critical need for sustainable financing in Nigeria. Lawal emphasised the urgency of addressing environmental challenges, stating, “With issues like flooding, pollution, and deforestation, we urgently need funds to tackle them. This is why we are approaching the market.”

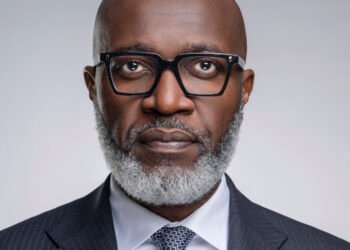

Commenting on the launch of the Impact Board, Gregory Jobome, Executive Director, Risk Management at Access Bank Plc, highlighted the Bank’s pioneering role in sustainable finance, noting, “As a leader in the issuance of corporate Green Bonds in Africa, Access Bank is committed to driving environmental sustainability and supporting projects that align with the Sustainable Development Goals (SDGs). The NGX Impact Board is a significant step towards fostering a greener and more responsible investment landscape.”

The Director-General of the SEC, Dr. Emomotimi Agama, reaffirmed the commission’s support for sustainable finance, saying, “We are ready to bolster the sustainable finance market, aiming to deepen it with diverse instruments that contribute to Nigeria’s sustainable development.”

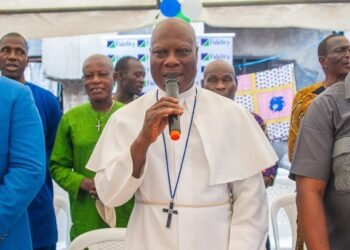

Dr. Umaru Kwairanga, Group Chairman of the Nigerian Exchange Group, expressed confidence the NGX’s capabilities, stating, “We possess the capacity, resources, and technology to raise the funds required by the Federal Ministry of Environment and the Nigerian economy to achieve the goals outlined in the Paris Agreement and the Sustainable Development Goals.”

Access Bank has consistently demonstrated leadership in climate finance across Africa, exemplifying a strong commitment to sustainable environmental practices and financial solutions. In June 2018, the Bank supported the Green Bond Market Development Programme organised by FSD Africa, the Climate Bonds Initiative (CBI), and FMDQ Group PLC, aiming to develop a non-sovereign green bond market in Nigeria. This initiative sought to entrench sustainability principles into the Nigerian capital markets and support broader debt capital market reforms to facilitate the transition to a climate-resilient economy.

In April 2019, Access Bank issued its inaugural green bond, valued at NGN 15 billion (USD 41 million), becoming the first African corporate entity to receive CBI certification. The bond, listed on multiple exchanges including the FMDQ OTC Securities Exchange, Nigerian Stock Exchange, and Luxembourg Green Exchange, set the tone for the continent’s appetite for green capital. Building on this success, the Bank issued USD 50 million Reg S Step-Up Green Notes in 2022 under its US$1.5 billion Global Medium-Term Note Programme, further solidifying its commitment to sustainable financing.