One of the victims of the recently crashed Ponzi scheme disguised as a trading platform, CBEX, has cried out after losing an investment worth $1000 without getting her returns before the scheme crashed.

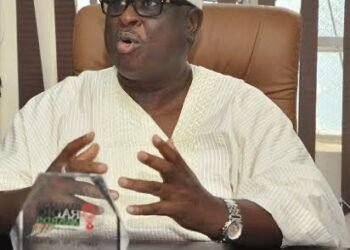

The woman, known as Bolarinwa, stormed the CBEX office on Tuesday morning in tears, expressing her pain following the crash of the scheme on Monday evening, April 14.

In an interview with newsmen, Bolarinwa revealed that she was introduced to the scheme by one of her neighbours who had benefited from the platform.

She narrated that she had just returned from Libya, where she incurred several injuries while working and only returned to Nigeria with $200.

“ Personally, I invested $200 but I collected all my friend’s money to invest $1000. I went to Libya to work and it was with so much fighting and when I got back, my neighbor introduced CBEX to me. I saw the money he collected from CBEX and he said I should do it so that I can get times two of what I invested.

“My own money there is $200 but I collected from my friends to make it $1000.”

Bolarinwa’s ordeal is just one out of the millions of Nigerians who were victims of the Ponzi scheme. Nigerians had gone the extra mile to erect offices for the scheme, as they believed it was a formidable scheme that would continue to thrive. However, many were heartbroken when the scheme crashed on Monday.

What you should know

On April 5, CBEX announced across its Telegram platforms that there would be a free bonus for investors between April 9th and 14th. Many were more concerned about the bonuses but little did they know that withdrawals would be paused. However, after getting bonuses as high as $100, attempts to withdraw were paused on April 9 with a promise that they would be opened on April 15.

Until noon of April 14, the platform assured investors that withdrawal would be available in the next few hours, till investors suddenly discovered that all their earnings had disappeared, indicating the ultimate crash of CBEX.

What CBEX is saying

The platform, as is typical of a Ponzi scheme, has locked its Telegram platforms and explained that there was a hack attempt that brought a surge in the trading system, making the AI to trade with all investors’ funds, leading to a loss.

However, the platform further encouraged investors to deposit $100 for those who have less than $1000, and $200 for those who have more than $1000 to reclaim their funds.

Watch the video below.