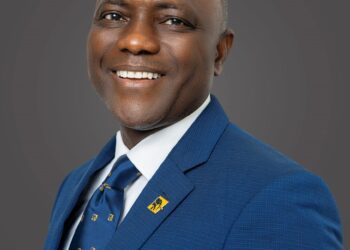

Zenith Bank ended 2023 on a high with a remarkable triple-digit topline and bottom-line growth.

Glamtush reports that Zenith Bank Plc has announced its audited results for the year ended December 31, 2023, achieving a remarkable triple-digit growth of 125% in gross earnings from NGN945.6 billion reported in 2022 to NGN2.132 trillion in 2023.

According to the audited financial results for the 2023 financial year presented to the Nigerian Exchange (NGX), this impressive triple-digit growth in gross earnings resulted in a Year-on-Year (YoY) increase of 180% in Profit Before Tax (PBT) from NGN284.7 billion in 2022 to NGN796 billion in 2023. Profit After Tax (PAT) also recorded triple-digit growth of 202% from NGN223.9 billion to NGN676.9 billion in the period ended December 31, 2023.

The increase in gross earnings is primarily due to growth in interest and non-interest income. Interest income increased by 112% from NGN540 billion in 2022 to NGN1.1 trillion in 2023. Non-interest income grew by 141% from NGN381 billion to NGN918.9 billion in the same period. The increase in interest income is attributed to the growth in the size of risk assets and their effective repricing, alongside the rise in the yield of other interest-bearing instruments over the year. Growth in non-interest income was driven by significant trading gains and an increase in gains from the revaluation of foreign currencies.

The cost of funds grew from 1.9% in 2022 to 3.0% in 2023 due to the high interest rate environment while interest expense increased by 135% from NGN173.5 billion in 2022 to NGN408.5 billion in 2023.

Notwithstanding the 32% growth in operating expenses in 2023, the Group’s cost-to-income ratio improved significantly from 54.4% in 2022 to 36.1% in 2023 due to improved top-line performance. Return on Average Equity (ROAE) increased by 118% from 16.8% in 2022 to 36.6% in 2023, underpinned by improved gross earnings, as the Group sought to deliver better shareholder returns. Return on Average Assets (ROAA) also grew by 95% from 2.1% to 4.1% in the same period.

The Group has continued to deepen its market leadership in key corporate and retail deposit segments as customer deposits increased by 69% from NGN9.0 trillion to NGN15.2 trillion in 2023. Its retail drive continues to yield dividends as retail deposits now constitute 46% of total deposits (compared to 44% in 2022) and grew by 77% from NGN3.97 trillion in 2022 to NGN7.04 trillion in 2023, also reinforcing increased customer confidence in the Zenith brand.

Total assets increased by 66% from NGN12.3 trillion in 2022 to NGN20.4 trillion in 2023, largely due to growth in total deposits and the revaluation of foreign currency deposits. Gross loans grew by 71% from NGN4.1 trillion in 2022 to NGN7.1 trillion in 2023 due to the revaluation of foreign currency loans and the growth in local currency risk assets. As a result of the disciplined and diligent approach to risk assets creation and management, the loan growth did not significantly impact the Non-Performing Loans (NPL) ratio, which increased marginally from 4.3% to 4.4% despite the heightened risk environment and challenging operating environment, an attestation to the Group’s resilience despite headwinds and a challenging macroeconomic environment. Also, the prudential ratios remain within regulatory thresholds, with the Capital Adequacy Ratio (CAR) and liquidity ratio at 21.7% and 71.0%, respectively, at the close of 2023.

As a demonstration of its commitment to shareholders, the bank has announced a proposed final dividend payout of NGN3.50 per share, bringing the total dividend to NGN4.00 per share.

In 2024, the Group will complete the transition to a holding company structure, which is anticipated to position it advantageously for exploring emerging opportunities in the Fintech space while bolstering its digital and retail banking initiatives. Furthermore, the Group is undertaking urgent necessary actions to meet the new minimum NGN500 billion equity capital requirement to maintain its international authorisation within the timeframe stipulated by the Central Bank of Nigeria (CBN). This will strengthen its presence in key markets to continue positioning for sustainable growth and value addition for stakeholders.

Zenith Bank’s track record of excellent performance has continued to earn the brand numerous awards, including being recognised as Best Bank in Nigeria, for the fourth time in five years, from 2020 to 2022 and in 2024, in the Global Finance World’s Best Banks Awards; the Best Bank for Digital Solutions in Nigeria in the Euromoney Awards 2023, being listed in the World Finance Top 100 Global Companies in 2023; being recognised as the Number One Bank in Nigeria by Tier-1 Capital, for the 14th consecutive year, in the 2023 Top 1000 World Banks Ranking published by The Banker Magazine; Best Commercial Bank, Nigeria, for three consecutive years from 2021 to 2023, in the World Finance Banking Awards; Best Corporate Governance Bank, Nigeria in the World Finance Corporate Governance Awards 2022 and 2023; Bank of the Year (Nigeria) in The Banker’s Bank of the Year Awards 2020 and 2022; Best in Corporate Governance’ Financial Services’ Africa, for four successive years from 2020 to 2023, by the Ethical Boardroom; Most Sustainable Bank, Nigeria in the International Banker 2023 Banking Awards; Best Commercial Bank, Nigeria and Best Innovation in Retail Banking, Nigeria in the International Banker 2022 Banking Awards.

Also, the bank emerged as the Most Valuable Banking Brand in Nigeria in the Banker Magazine Top 500 Banking Brands 2020 and 2021; Bank of the Year 2023 and Retail Bank of the Year for three consecutive years from 2020 to 2022, at the BusinessDay Banks and Other Financial Institutions (BAFI) Awards. Similarly, Zenith Bank was named Bank of the Decade (People’s Choice) at the ThisDay Awards 2020, Bank of the Year 2021 by Champion Newspaper, Bank of the Year 2022 by New Telegraph Newspaper, and Most Responsible Organisation in Africa 2021 by SERAS Awards.