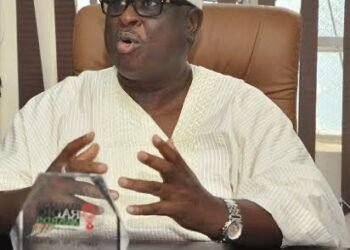

The Group Chief Executive Officer, Nigerian National Petroleum Company Limited, Mele Kyari, on Thursday, allayed the fear of Nigerians on the rising prices of Premium Motor Spirit, known better as petrol across the country.

The NNPC boss said competition among major players in the oil sector would force down the price of petrol as against the upward trends that have caused panic in the country.

This online newspaper reports that queues returned to fuel stations across the country following the recent increase in the petrol pump price occasioned by the discontinuance of petroleum subsidy.

Earlier on Wednesday, the NNPC said it had adjusted the pump price of petrol to reflect the market realities. The agency, however, failed to state the new prices of petrol.

However, several retail outlets sold the product between 600 and N800 in Lagos, Abuja, Ogun and some other states.

Also, talks between the Federal Government and organised labour over the removal of fuel subsidy ended in a deadlock on Wednesday as they failed to reach a consensus following the hike in petrol pump prices to over N700 from N195 per litre by oil marketers.

Speaking on Thursday in an interview on Arise TV’s Morning Show, Kyari said the removal of subsidy would allow new entrants into the market, a move he said, would aid competition and phased out monopoly.

This, he claimed, would ensure healthy competition which would ultimately lead to a downward review of pump prices of petroleum across the country.

He said, “The beauty of this (subsidy removal) is that there will be new entrants (into the market) because oil marketing companies’ reluctance to come into the market all along is the very fact of the subsidy regime that is in place.

“And that subsidy regime doesn’t have a guarantee of repayment back to the those who provide the product at subsidise price and now that the market is being regulated, oil marketing companies can actually import product or even if it is produced locally, they can buy and take it into the market and sell it at its retail price.

Therefore, you will see competition, even with NNPC. And by the way, by law, NNPC cannot do more than 30 per cent of the market going forward. As soon as the market stabilises, oil marketing companies are able to come in…

“Competition will definitely come in and the market will regulate the prices itself. Therefore, this is just an instantaneous price and within a week or two, you will continue to see different prices because of different approaches from major players, companies have different approaches to it and competition will guide that. Ultimately, you’d see changes downwards and it is very likely because efficiency will come in.

“As soon as competition comes in, people will become more efficient in their depots, in managing their trucks and in managing their fuel stations so that people can come to their stations. And it is showing already, right now, you will see motorists going to stations where they can have price differences, so this will regulate the market and on its own, the price will come down naturally and I don’t see any doubt about this.”

On why fuel stations hiked their pump price when they still have in stock already subsidised products, the NNPL boss said “This is the reality of the market. It applies to every commodity and not just petroleum.”

He added, “It could have been the other way round, prices could have collapsed downwards and those holding the old stock will have to sell at lower prices to arrive at market condition.

“It is not something serious or strange, this is a stock management issue and it is very typical, no one can do anything different about this.

“The prices we are seeing today at our station are the current price of the commodity. This means that prices in the market can go down at any time and of course, the market will adjust itself.”